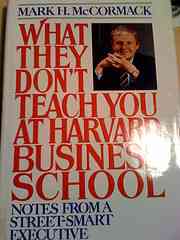

Larry Chiang scandalously shows granular tid-bits in how to start as an entrepreneur. He edits the Bloomberg BusinessWeek channel “What They Don’t Teach You at Business School”. After Chiang’s Harvard Law keynote, Harvard Business wrote: “What They Don’t Teach You at Stanford Business School“ (its the same title as his NY Times bestseller). If you read his scandalously awesome “What a Supermodel Can Teach a Stanford MBA” and “How to Get Man-Charm”, you will like his latest post:

How to Hack Into a VCs Rolodex (And Have Her Thank You)

|

By Larry Chiang

VCs have amazing business contacts. I argue that those contacts are as valuable as their money.

As an entrepreneur active in Palo Alto California, I witness VCs making positive introductions for their portfolio companies and prospective investments. The challenge is how do we take the first couple of steps towards making this happen. I argue that in addition to being school smart, you have to sprinkle in street smarts. I collect, curate, archive and publicize stuff that they don’t teach in school. It pays homage to my mentor, Mark McCormack who wrote, ‘What They Don’t Teach You at Harvard Business School’

Getting a VC who has not funded you to open their rolodex is definitely street smart. Here is how to get access to a VC’s business network in some scandalously awesome ways.

-1- Charm Their Entourage

Yes, VCs have an entourage.

VCs partners who speak at a conference often will ‘plus one’ an associate. The common cliche scenario is when the partner and associate are walking, she will get stopped by people wanting to meet and her associate will be in what I call ‘conversation limbo’. People naturally talk to the partner but ignore the associate putting the associate in limbo. I see this as an opportunity and man-charm the crap out of her associate. My goal in kissing associate butt is to be one or two of the stand-out people that their entourage brings up later when the group is summarizing their day.

VCs are similar to the old music executives that buffered themselves from new talent by using layers of associates. Bypassing those barriers in venture capital is similar where we want to be pre-sold to the VC by wooing their entourage

-2- Be the Assistant to Their Assistant

Silicon Valley does not need another alpha.

I propose that in order to hack into a VCs rolodex, be more of a beta or gamma male. Gamma are below alphas and betas. Gamma males are an assistant to an assistant. Alpha males that act as a gamma to a beta is a complicated way to say, be the assistant to a VCs assistant.

For example, lets say you hear of something that is pertinent to a VC. I ping the assistants cell phone or Facebook message them. I am adding value by coming up with something extremely easy to forward. In short, I want to help them do their job. I want to help the VCs assistant so that my name percolates up.

-3- Get A Warm Intro from a Conference Producer Who You’ve Helped

Boondoggles, also know as conferences, are where VCs go about three to five times per month.

They gripe and moan when they have to pay because often times they are invited free by a conference producer. The VC owes the conference producer (and in many cases trusts the person to identify rising trends and emerging new companies).

Your goal is to get an introduction from a conference producer. Warm intros are easier after establishing yourself as a domain expert.

Expert formula:

Use Brendon Burchard’s expert formula:

A) tell them what to pay attention to

B) tell them what things mean

C) how things work

D) tell them how things might work out

For example, this is how I applied the experts’ formula:

a- CARD Act is legislation that had unintended consequences

b- Young adults who are freshman can only use debit cards

c- Debit cards do build credit & aren’t reported to Trans Union, Experian and Equifax

d- Duck9 solves the catch 22 of credit by lowering credit lines to $60 and repossessing Nike dri-fit, LuLu Lemon and Follet’s textbooks if payments are not made

A warm intro to a conference producer is very similar to when a VC relies on her entourage or portfolio’s founders or network of influencers to filter out who to meet and spend more time with.

-4- Get Mentored By Them

In addition to money, VCs have a great deal of consulting flavored advice for startups. If you want their money or their network, you are first going to have to sit through their advice. Here are some granular tid-bits into the street smart method of how this gets done

a) Mentor ledge: a quasi cold-call for a meeting where your intention is to get one or two quick questions answered via live contact. No you’re not meeting for a coffee. You are meeting over the phone

b) Mentor marketing: ideally you would not elevator pitch the VC but simply educate as to the problems in the industry and how you are taking a big whack at solving it. You are marketing your startups solution while mentoring them about your industry

c) Mentor momentum: they give you advice, you hear it, notate it, take action on it, follow-up on it and document it via emails with unique subject lines. Momentum builds when they sprout out knowledge and see a bump up in shareholder equity. Bonus points if you send them a thank you gift or real world, snail mail card. (see tip #7)

Getting mentored by a VC is an art. It increases your probability of getting access to their list of business contacts.

-5- Sparingly Use Social Media

No premature Facebook friend-ification.

VCs that get social media invitation requests too quickly get annoyed. I might use Facebook to message them in a campaign to get their initial attention but I caution you against tweeting at them, Facebook liking, Quora voting or Tumblr re-blogging.

As Mike Arrington said at Y-Combinator’s Startup School in 2008, “You want to strongly jerk the collar ONCE when you have something important.” He was talking about how to get a bloggers attention but it also applies to popular VCs. Do not overuse social media. This leads to my next point…

-6- Pre-Network Via Cold Telephone Call

It is true, most VCs will pocket veto you and ignore most initial attempts to network with them. A pocket veto is saying no to you by doing nothing.

The VC has installed a system of natural buffers that keep them from front-line contact. Its a system engineered to have the cream rise. Beat the catch 22 of what comes first the mentor or their network by pre-networking via the phone call.

There is a street-smart skill that very few tech founders possess. How do you cold call and effectively leave voice mail messages to push yourself on them is something they do not teach you at computer science school.

Before you pooh-pooh this needed form of pre-networking, know that 80% of CEOs have sales experience. Sales experience hinges on the ability to make a cold call.

But, Larry Chiang…, I wouldn’t stoop to that because VCs will frown on that. Here is how I respond:

– VCs are impressed. Lets say you leave 5 unrequited voice mail messages for a VC. They do not think- OOoh, stalker. They think, I bet they will call a prospect, client or distribution channel partner in order to push their deal along

– VCs notice. Calling a person in Silicon Valley is just plain weird. If you are a CS major that talks you get kudos. I know of VCs that pre-fund pre-founders who are CS majors just because they can string together two sentences of public speech and are on-schedule to graduate. What I mean by pre-fund a pre-founder is that the VC will give a quasi grant of 25 or 50k and say “I get a look at what you’re doing 6 months from now”.

– Failing is sexy to a VC. There is no more vulnerable of a feeling than trying to call someone and having that call not go well. Failing forward is sexy to most VCs

– VCs like people that are up and to the right. X axis being coding and y-axis is communicating. Just because you aggressively sell does not mean you are worse are coding. You want to be in the quadrant in the upper right where you can communicate well and code well. CS majors frown on other CS major that talk well. As my mentor John Marchelya says, “Just because I am president of Kappa Sig’s, doesn’t make me a bad engineer. It makes me an engineeer who is also good at communicating”.

CS majors have an easier time learning CEO skills than it is for CEOs to learn CS skills. As a CS major, having some sales skill loaded up is more potent that Keanu Reeves from the Matrix knowing karate and jiu jitsu. True story.

-7- Tip, Reward, Comp and Tip a VC

I said tipping twice because I really like to tip. It helps me outflank teams of MBAs. When they help you a little, entzy, weentzy little bit, tip them. It can come in the form of flowers, chocolate, a gift card or something that conveys a message. How you give a gift is very difficult but the thought is tantamount.

To hack into a rolodex, I recommend putting as many VCs as possible on your payroll. I don’t mean that California kind that requires you to pay state, Fed and social security… I am talking the Chicago, old-school mobster kind of payroll where you tip and gift (But you must disclose and 1099 any dollar amount over $2000). “Paying” your VC for getting help with an introduction is very street smart. Do you think paying for introductions is gross?? Hmmm, lets examine that.

In college, they educate you by introducing you to maybe 10 decent professors and maybe 10 decent companies at the placement office. Doing some quick and rough math, I paid about 50k for engineering school and executive education in Philadelphia. I met about 50 good people so I paid $1k per. Most people pay about $120k for undergrad and meet a fraction of the people I meet. Please think about paying some real world tuition. Please think about tipping your VC.

-8- Advanced Tip: Leverage The Bad Introduction

You will often get a first intro that is bad. Think of it as a test.

Maybe the VC wants to test you. Maybe you don’t value a meeting with a person. Maybe you think its bad but it is actually good. If you don’t want your new friend to be a broken branch friend, I recommend you work with this bad intro. A broken branch friend is a person you know who won’t introduce you to any more people.

Think of this first intro as a first interview. Supermodels call a first introduction a go-see or cattle call. Here is how to leverage the first introduction

• Sell the VC to the introducee

• Help the first introducee

• Take a couple of handwritten notes

• Follow-up

Promoting the introducer to the introducee is critical. Go back to the VC with a thank you and later, get a real intro to someone that you need

This wraps up my tips as I am going back into the Vancouver network I am crashing with the help of some investors and try to execute what I just preached

** BIO **

Larry Chiang started a company in his dorm room that credit educates college students. He contributes to TechCrunch under ‘What They Don’t Teach You at Stanford Business School’. On Facebook’ , he is his own executive admin for his 25 person fan page

*** BONUS ***

a party invite for you:

http://economist.eventbrite.com/

What a Supermodel Can Teach a Harvard MBA

If you liked this…

Larry’s mentor Mark McCormack wrote this in 1983. His own book came out 09-09-09. It is called ‘What They Don’t Teach You At Stanford Business School‘

This post was drafted in an hour and needs your edits… email me if you see a spelling or grammatical error(s)… larry@larrychiang com

Larry Chiang started his first company UCMS in college. He mimicked his mentor, Mark McCormack, founder of IMG who wrote the book, “What They Don’t Teach You at Harvard Business School”. Chiang is a keynote speaker and bestselling author and spoke at Congress and World Bank.

Text or call him during office hours 11:11am or 11:11pm PST +/-11 minutes at 650-283-8008. Due to the volume of calls, he may place you on hold like a Scottsdale Arizona customer service rep. If you email him, be sure to include your cell number in the subject line. If you want him to email you his new articles…, ask him in an email

You can read more equally funny, but non-founder-focused-lessons on Larry’s Amazon blog .

{ 1 comment… read it below or add one }